IPO Investing: Unraveling the Pros & Cons – Weighing the Reasons to Invest

Discover the delicate balance of pros and cons that accompany IPO investing. Gain a comprehensive understanding of why investing in IPOs could lead to promising outcomes or present financial pitfalls, enlightening your investment vision.

Introduction: The IPO Investment Conundrum

Welcome, fellow seekers of investment wisdom! Embark on an enriching voyage focused on the enchanting realm of Initial Public Offerings (IPOs). This enlightening exploration sheds light on the pros and cons of IPO investing, empowering you to make informed decisions on your investment journey.

Weighing the Pros: The Gilded Opportunities of IPOs

Success in IPO investing can lead to lucrative gains shaped by multiple factors inherent in Initial Public Offerings. Here are some of the advantages that draw investors to IPOs:

- Price Advantage: Investors can often obtain shares at a lower cost during the IPO, opening the door to potential profits as the share price hits the market and displaces initial valuations.

- New Beginnings: IPOs present the opportunity to invest in innovative, ground-breaking companies at their inception in the public market, enabling investors to ride the wave of the company’s success from its very foundation.

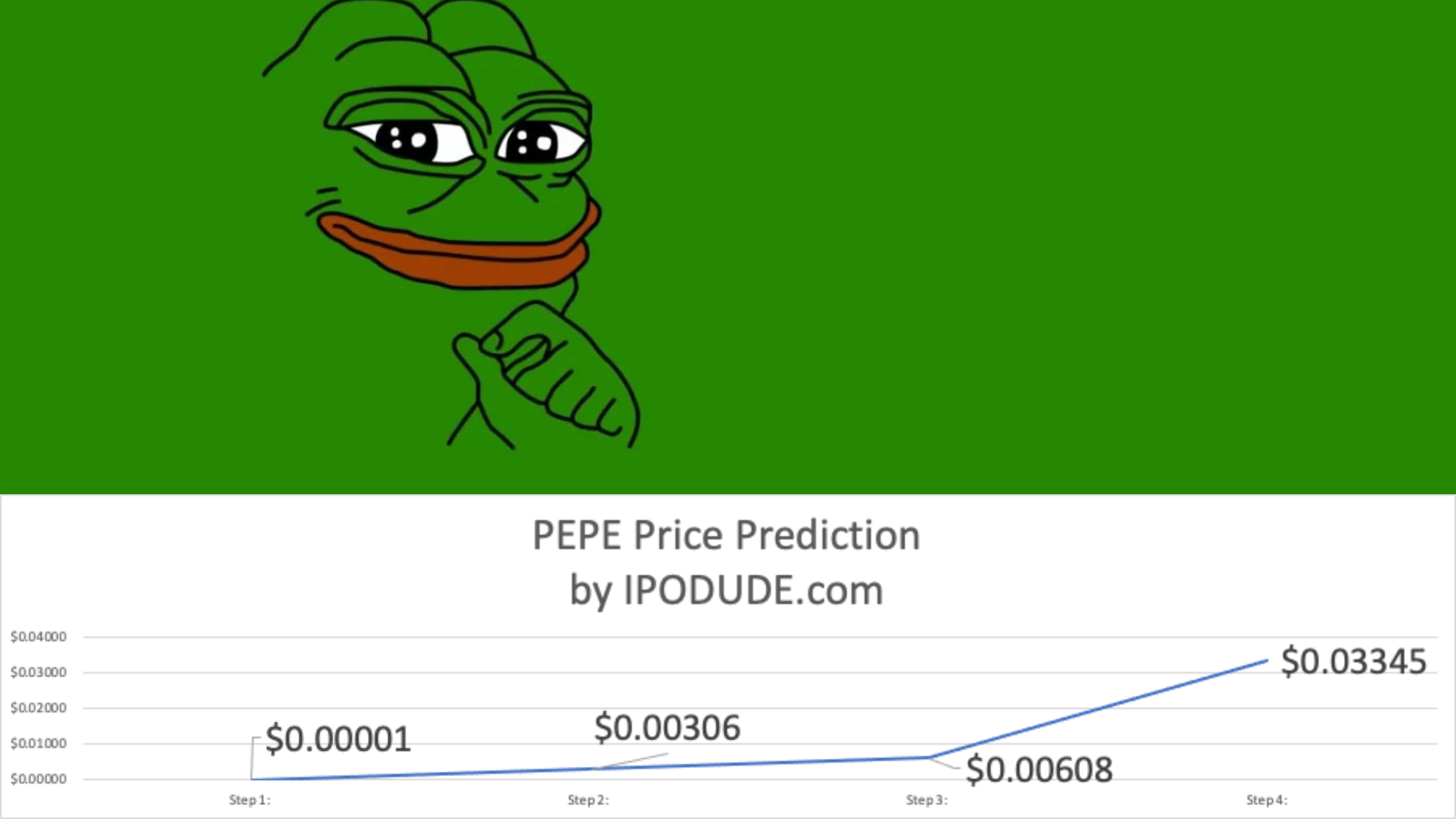

- Potential for Quick Gains: Occasionally, shares of a highly sought-after IPO may experience a significant price hike on the first day of trading, known as an IPO pop, presenting an attractive prospect for timely profit realization.

Dissecting the Cons: The Potential Perils of IPOs

While IPOs present an alluring prospect to the enterprising investor, it is essential to acknowledge the potential hazards intertwined with IPO investing:

- Lack of Historical Data: As new entrants to the public market, these companies often lack the comprehensive, historical financial data required to evaluate their potential thoroughly. This absence can make it challenging to gauge the investment.

- Underperformance Risk: Post-listing performance might not lead to immediate gains, and some IPOs may lose their initial momentum, impacting an investor’s potential return on investment.

- Limited Allocation: High demand for IPO shares means allocating the desired shares may be tricky. Retail investors may face even more significant challenges as institutional investors often enjoy priority in IPO allotments.

Conclusion: A Balanced Approach to IPO Investing

IPO investing is a captivating blend of opportunities and uncertainties. Understanding the intricate balance of pros and cons allows you to chart a course resolutely with informed decisions and confidence. Embrace the transformative power of knowledge, for it empowers you to shape your future and thrive in the ever-evolving world of investments.

Remember, as an informed investor in the world of IPOs, you are harnessing the power of innovation and shaping a diverse and interconnected financial ecosystem destined for shared prosperity and dynamic potential.

#IPOProsCons #InvestingWisdom #IPOInvestmentGuide #IPOOpportunities #IPOChallenges